People who are passionate about food will tend to think that putting up a restaurant business will be a good idea. However, with the number of technical things to remember when starting a restaurant business, it is important that you have the grit together with your love for the food that you are serving. Anyone who has ever watched Gordon Ramsay’s Kitchen Nightmares know that one cannot go without the other in order to maintain a sustainable restaurant business.

It is important to remember that efficiency and profitability does not happen overtime when it comes to a restaurant business. There are multiple factors to consider, which is why budding restaurateurs need their own restaurant business checklist of performance metrics that will help them catch both positive and negative business trends, that could help them optimize their business.

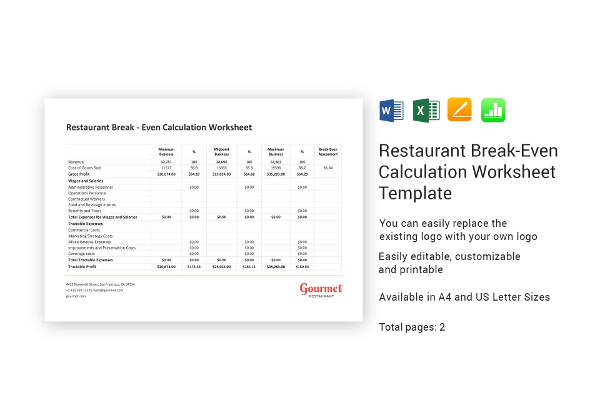

Break Even Point

The break-even point is among the first, most important numbers that any restaurateur should be able to calculate because this lets you know how much you should be doing in terms of sales in order to earn back your investment in your business. This number can then be used to calculate how long it will take you to earn back the money you’ve put in. This break-even number is also useful for justifying buying big purchases that can be used as restaurant investment, such as a commercial kitchen, a marketing campaign, or a bigger lease.

There are three variables to keep in mind when calculating your break even point: Fixed costs such as rent and wifi; variable costs that are dependent on sales volume such as manufacturing costs; and the selling price of the product.

- Break Even Point Calculation

Break Even Point in Units = Fixed Costs / (Price – Variable Costs)

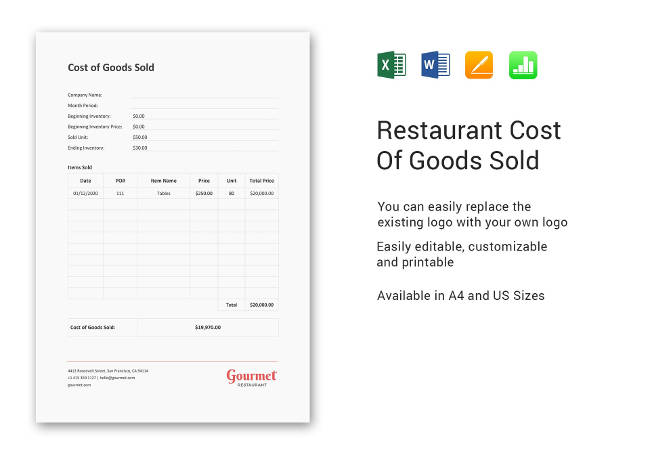

Costs of Goods Sold

The costs of goods sold serves as a representation of the restaurant’s inventory as it refers to the costs required to create the food and beverages that you sell to your guests. Recording COGS is important because it is among the largest expenses in restaurants. By identifying the costs of your food and beverages, you can find ways to minimize the costs, by negotiating better rates with your suppliers or distributors to increase your profit margins.

Calculating the cost of goods sold is important for three reasons: first, it is required for business taxes; second, it is important to keep track of profits, so that you will know whether or not it is worth staying in the restaurant business; and finally, it shows the areas of potential growth opportunities to improve your business.

- Calculating Costs of Goods Sold

Costs of Goods Sold = (Beginning Inventory Costs + Additional Inventory Costs) – Ending Inventory

Prime Costs

The prime costs of a restaurant includes the sum of all labor costs, including the salaries, hourly rates and benefits, as well as the COGS. Prime costs usually makes up around 60 percent of the restaurant’s total sales, and is considered important because it serves as the controllable expenses of your restaurant. You can find ways of decreasing your prime costs by managing your labor. By optimizing the staff that works in your restaurant, you will be able to decrease the costs of operations and increase profits.

- Calculating Prime

Costs Prime Cost = Raw Materials + Direct Labor

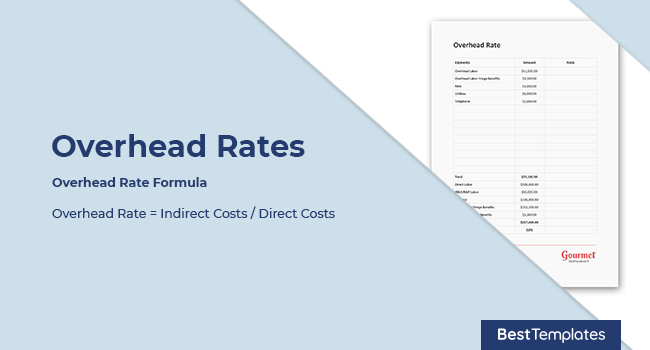

Overhead Rates

Knowing the fixed costs to run your restaurant is a good idea if only to assess your financial situation properly. However, while they are fixed, it will also help to know how much they cost for an hour to hour or day by day basis to help you with accounting. Some companies have several overhead rates, where overhead costs are divided into different cost pools, and allocated using different measures.

Companies with low indirect costs tend to have lower overhead rates, making them more competitive with other firms. The overhead rate is the sum of indirect costs. However, the cost of overheads can involve actual and budgeted costs, with a wide variety of allocated measures, including direct labor hours, square footage used, and even indirect costs of production.

- Overhead Rate Formula

Overhead Rate = Indirect Costs / Direct Costs

Food Cost Percentage

While the price of your food and beverages will depend on the cost of the ingredients as well as the novelty aspects of your servings, you have to understand the food cost percentage of each of your menu items. This is so that you’ll know whether you have to upsell them or promote them accordingly, especially those that contribute most to your revenue. To calculate your food cost percentage, simply divide your food cost by the total sale amount. Typically, your food cost percentage should be around 28 to 35 percent.

It’s important to compare your food costs in order to know whether or not you are turning a profit in your restaurant. One way of doing so is to compare your actual food costs to your ideal food costs. The food cost percentage does not go directly to the bank. However, optimizing your food cost percentage can help you reach the maximum profits. Knowing your food cost percentage will see you have better control over your restaurant’s profitability by pricing menu items based on costs of goods sold. It also ensures that you don’t have any wasted opportunities by changing or removing old menu items. It also gives you a better understanding on how orders affect your restaurant’s profitability.

- Calculating Food Cost Percentage

Food Cost Percentage = (Beginning Inventory + Purchases – Ending Inventory) / Food Sales

Employee Turnover Rate

The percentage of employees leaving your company at certain periods will make up your employee turnover rate. This includes voluntary resignations, dismissals, retirements, and even non-certifications. However this does not include internal movements such as promotions or department transfers. In calculating your monthly employee turnover rate, you have to know the number of active employees at the beginning and at the end of the month, as well as the number of employees that left during the same month. Most companies, however, find quarterly or annual turnover rates more useful in order to show meaningful patterns.

Knowing your industry’s average turnover rate is important to know whether or not your management is effective, and should therefore be ready to address some internal issues. Managers and employers typically dread turnovers due to the costs of training new employees. Keeping at the same or lower average turnover rate compared to others in the same industry will let you know whether or not you are keeping a healthy turnover. Don’t expect to keep your employees throughout the time you are operating your business because a zero turnover rate is unrealistic given that people move forward with their lives.

In calculating monthly employee turnover rates, divide the number of separations with the average number of employees during the month, then multiply the number by a hundred.

- Calculating Employee Turnover Rates

Monthly Turnover Rate = (Number of separations during the month / average number of employees during the month) x 100

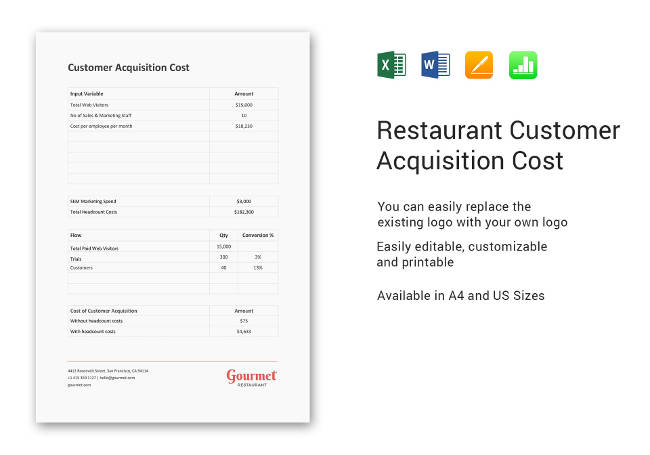

Customer Acquisition Costs

Customer acquisition costs are the amount it takes for you to convince potential customers to buy your products. With the emergence of internet companies and web-based advertising, it is easier to keep track of campaigns. The CAC Metric is important not only for the company, but for the investor as well. You can determine your company’s profitability by looking at the amount extracted from customers and the costs of extracting it. You can calculate the CAC by simply dividing all your company’s marketing expenses, then dividing it by the number of customers acquired in the period when the money was spent. Basically, if you spent $100 on marketing for the month and acquired 100 customers at the time, then the CAC is $1.00.

Of course, there is a caveat with using this metric. For instance, a company that made marketing investments in a new region, or during an early stage may not expect to see results until much later. Thus, it is important to account for multiple variations of the CAC metric.

- Calculating the Customer Acquisition Costs

Cost of customer acquisition = marketing campaign costs / total customers acquired

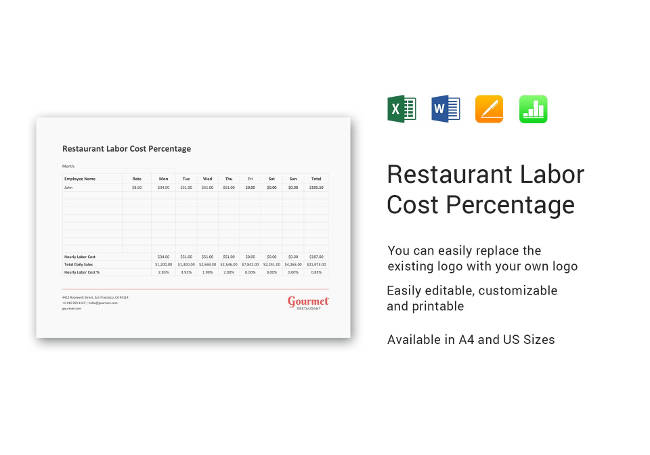

Labor Cost Percentage

The labor cost percentage shows you the amount being spent on labor, including paycheck, taxes, employee benefits. This same amount affects your prime costs, which is how you can examine the efficiency of your restaurant. Your total labor costs in the food service industry should average around 30 to 35 percent of your total revenue. It is especially important to be able to calculate your labor costs because it is, in most cases, the highest amount that goes into your restaurant, second only to rent.

Anything “labor-related” goes into the labor cost percentage calculation, including salaried employee wages, hourly employee wages, employee bonuses and overtime pay, payroll taxes, healthcare, and even sick and vacation days.

- Labor Cost Percentage Calculation

Labor Cost Percentage = (Labor Costs / Operating Costs) x 100

Customer Lifetime Value

The customer lifetime value is defined to be your future relationship with your customer. It can be used as the monetary value of your relationship, based on the present value of the future cash flows from your customers. This concept encourages businesses to shift their focus from short-term profits to long-term customer relationships. This represents the upper limit on the amount to spend in order to acquire new customers. Companies agree that a growing CLV is healthy for the organization and is considered a key measurement in a restaurant’s success.

The CLV may be useful, but can be difficult to calculate, especially considering the complexity of customer behaviors. Today, however, there are more advanced methods in calculating CLV, but there is a simpler formula that you can use to predict your restaurant’s CLV.

- Calculating Customer Lifetime

Value Customer Lifetime Value = ((Average monthly transactions x Average Order Value) Average Gross Margin) x Average Customer Lifespan in Months

Food Cost Variance

The cost variance can be any kind of expense in your business, from the elements that make up your cost of goods, to administrative expenses. This is a useful monitoring tool that shows how you spend company money in accordance with the amount you stated in your overall budget. Transactions happen on a daily basis in the restaurant business. Your staff could overlook price fluctuations, so there are times when the staff overlooks price fluctuations. However, you have to take note that the cost variance is considered favorable when the actual cost is lower than expected. On the other hand, it is considered unfavorable when the costs incurred is higher than the amount budgeted. It is important to have a proper handle on your food cost variance in order to cost your menu correctly and forecast your profits as accurately as possible.

The cost variance formula consists of the volume variance and the price variance. The volume variance is the difference in the actual and expected unit volume, while the price variance is the difference between actual versus expected price, multiplied by the standard number of units. When you combine the volume and price variance, you will come to the total cost variance for the expenditures incurred.

- Cost Variance Formula

Cost Variance = (Actual Price x Actual Quantity) – (Standard Price – Standard Quantity)

Menu Engineering

Studying the profitability and popularity of the menu items at your restaurant will influence their placement on the menu. The main goal of menu engineering, therefore, is to maximize the profitability per guest. Menu engineering helps businesses organize their products in a way that facilitates a customer’s decision-making. While many restaurants speak of menu engineering in the traditional sense, it could still work with menus posted online.

A well-executed menu will increase your restaurant’s profits by at least 10 percent as you sell strategically placed items in the most ideal places on your menu board. In order to maximize the process, you have to craft your menu in the following steps:

- Cost of your Menu – this means you break down every item to individual ingredients and figure out at how much you can price your items.

- Categorize Items According to Profit and Popularity – this will allow you to determine how to apply menu engineering efforts to your printed menu.

- Design the Menu – highlight the items that you want to sell most, and include visual cues as you see fit.

- Test the New Design – test your new menu as necessary and see if there are any improvements in your profits. When it comes to designing your restaurant menu, you need to continually test designs for profit improvement.

Menu Engineering Equation

Unlike other equations, menu engineering will require you to plot your menu items in one of four quadrants. From the upper left corner going clockwise, you will place your items accordingly.

- Upper left quadrant – low profitability but high popularity items

- Upper right quadrant – high profitability and high popularity items

- Lower right quadrant – high profitability but low popularity items

- Lower left quadrant – low profitability and low popularity items

Return on Investment

Your restaurant’s return on investment (ROI) is used to evaluate the efficiency of your investment, measuring the amount of time to return an investment relative to its costs. The ROI is especially popular because of its versatility and simplicity. If an investment’s ROI proves to be negative, or if you find other opportunities to have a higher ROI, then you or your investors can find the best options for your restaurant. ROIs are measured as percentages, so it can be compared with returns from your other investments, allowing you to measure different types of investments from one another.

- Return On Investment Computation

ROI = (Gain from investment – Cost of Investment) / Cost of Investment

Restaurant Payroll Costs

The less that you spend on payroll, the more money that you have left in your bottomline. However, too many restaurateurs make the mistake of cutting them too low, so customers spend long wait times and bad food quality due to the mealtime rush and lack of attention to guests. The average restaurant is expected to cost 25 to 35 percent of their gross sales on payroll, depending on the establishment. The fancier the restaurant, the more people expect to pay for the service and experience, so fine dining restaurants usually spend around 35 to 40 percent of their revenue for payroll.

- Payroll Costs Inclusions

Payroll costs = employee salaries + liabilities + federal income taxes + FICA and health and benefit plans

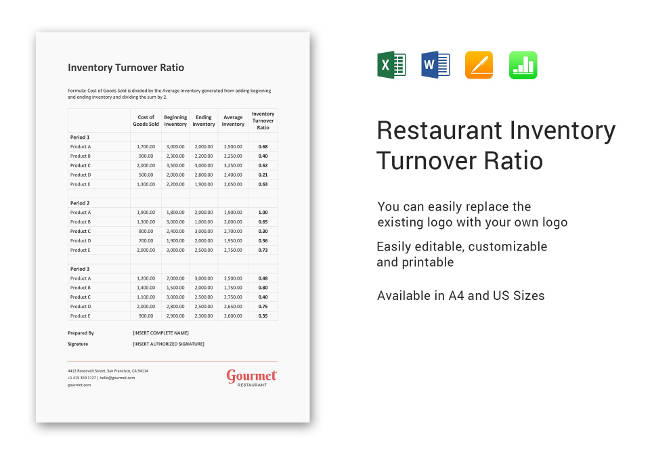

Inventory Turnover Ratio

The inventory turnover ratios show you how effectively you are managing your inventory by comparing your cost of goods sold with your average inventory over a certain period. Simply put, it measures how often your restaurant sells its total average inventory in dollar amount during the year. For instance, if your average inventory costs $1000 and you had sales worth $10,000 over the course of the year, that means you sold your inventory 10 times over.

This ratio is particularly important because of the two main components of your restaurant: stock purchasing and sales. If you are not able to sell your inventory, you will incur storage and other holding costs, so sales have to match the inventory purchases in order to get a good turn of profit.

In order to get the inventory turnover ratio, you will have to divide the cost of goods sold over a certain period by the average amount for inventory. Average inventory is typically used because merchandise fluctuates throughout the year and some restaurants buy in bulk ingredients that can be used over the entire year.

Inventory Turnover Ratio Equation

Inventory turnover ratio = Cost of goods sold / average inventory

There are over one million restaurants in the US alone, and every year, the number grows rapidly. Because of this, there is endless competition in the industry that new restaurant owners must deal with, and restaurant promotion ideas simply aren’t enough. According to research, 90 percent of restaurants fail in the first year, and 80 percent don’t make it past five years. Among the main reason for such failure is that the owners failed to pay attention in tracking performance metrics, and problems were not identified in time.

A good restaurateur should be able to immerse himself in the work process of the business and understand its health, not rely merely on the passion for food to run a profitable restaurant. This is why learning and understanding the key metrics is essential for your success, as it helps you gather data that measures your restaurant’s profitability in more than one aspect, so learn about these restaurant metrics as early as you can now.